Is there really a difference between saving and Investing

Saving Vs Investing

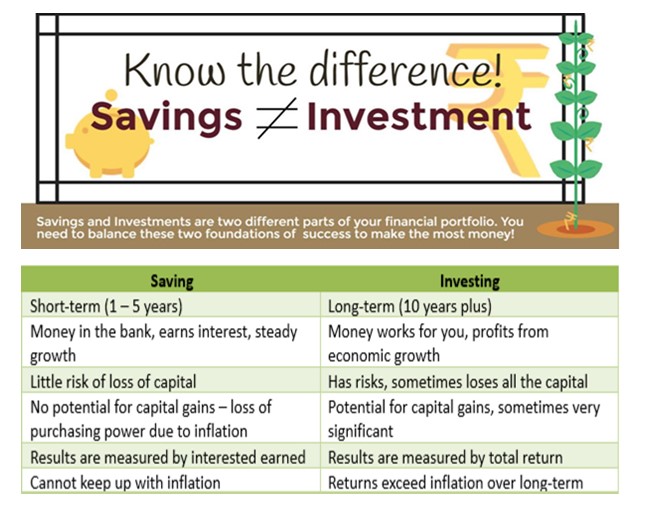

Most of us think that Saving and Investing are the same thing. While the terms are often used interchangeably by many, they are as different as chalk and cheese. The difference between your monthly income and your expenses is what constitutes your “savings”.

But when you multiply the money you save by putting it in various asset classes such as stocks, bonds, real estate or gold, you are creating wealth by

“investing”.

Savings

1. Hard cash or the amount that lies in your bank account and earns nominal returns

2. Savings help you meet short-term goals such as going on a vacation or

buying a gadget

3. Savings can be stashed away in the form of cash or in a bank account so

little or no risk is involved

4. Money in a bank savings account earns a low return

Investment

1. Savings invested in various asset categories earn you a substantial profit

2. Investing money helps you meet long-term goals like buying a house

3. When you invest there are some risks involved like fluctuating interest

rates or other economic conditions that can lead to losses

4. Investing money has the potential for profits that increase your net worth

and help you build wealth over time