Are your Investments Tax Efficient?

How to invest tax-efficiently Create a strategy to help manage, defer, and reduce taxes Tax Smart Investment strategies you should consider While tax rules and rates may change over time, the value of keeping taxes in mind when making investment decisions does not. The reason? Taxes can reduce your investment returns from year-to-year, potentially jeopardizing […]

Before you tread the path….

Is there really a difference between saving and InvestingSaving Vs Investing Most of us think that Saving and Investing are the same thing. While the terms are often used interchangeably by many, they are as different as chalk and cheese. The difference between your monthly income and your expenses is what constitutes your “savings”. But […]

SOVEREIGN GOLD BOND

Sovereign Gold Bonds (SGB) are issued by Reserve Bank on behalf of Government of India and are traded on Stock Exchanges. SGBs are government securities denominated in grams of gold. Issuer: Reserve Bank on behalf of Government of India Date of subscription – May 11,2020 û May 15, 2020 Why to invest in SGB: ▪ Bond carry sovereign guarantee […]

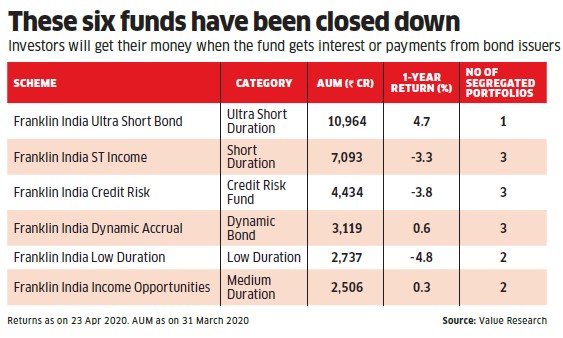

Franklin Templeton winds up 6 Credit Risk Oriented Debt Funds. What does this mean for you?

What happened? Franklin Templeton Mutual Fund has decided to wind up (read as permanently shut down) the following 6 schemes and return the money back to investors albeit with a delay. Franklin India Low Duration Fund (No. of Segregated Portfolios – 2) Franklin India Ultra Short Bond Fund (No. of Segregated Portfolios – 1) Franklin […]